1. Finance and accounting expertise: solid knowledge of accounting, finance, economics, taxation, business law, and social law.

Chief Financial Officers (CFOs) manage an organization’s financial strategy and long-term stability. With growing challenges linked to globalisation, regulation, and digital transformation, their role now goes far beyond accounting. Today, CFOs play a key part in strategic decision-making, performance optimization, and investment planning. Here’s what the job involves and how to prepare for it.

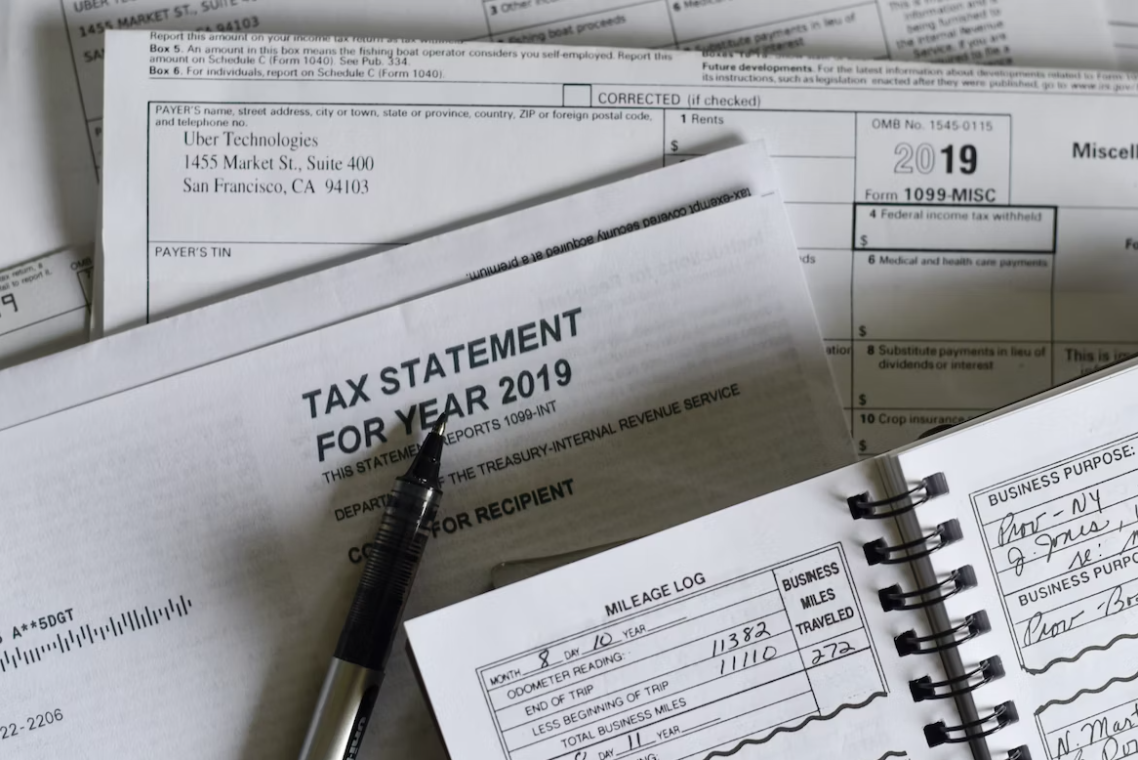

Chief financial officers are responsible for the financial and administrative management of a company. Their work covers a broad range of areas including cash flow, taxation, commercial strategy, and legal oversight. As senior executives and members of the management committee, they develop and implement financial policies while also advising top management on strategic decisions.

The role of Chief Financial Officer is highly demanding. A CFO is a professional with a wide range of skills who is committed and rigorous in their work. This is why companies prefer to entrust this position to experienced profiles.

The role of CFO may also be known as:

Over the course of their career, administrative and financial directors may progress to senior management positions. There are several possible career paths; here are a few examples: